Business Insurance in and around Missoula

One of the top small business insurance companies in Missoula, and beyond.

Almost 100 years of helping small businesses

Insure The Business You've Built.

As a business owner, you have to manage all areas of business, all the time. The details can be overwhelming! You can maximize your efforts by working with State Farm agent Darby South. Darby South can relate to where you are because all State Farm agents are business owners themselves. You'll get a business policy that covers your worries and frees you to focus on growing your business into the future.

One of the top small business insurance companies in Missoula, and beyond.

Almost 100 years of helping small businesses

Protect Your Business With State Farm

That's because a small business policy from State Farm covers a wide range of concerns. Your coverage can include a business owners policy that provides for loss of income (for up to 12 months) in the event your business is shut down. It not only protects your wages, but also helps with regular payroll expenditures. You can also include liability, which is critical coverage protecting your financial assets in the event of a claim or judgment against you by a consumer.

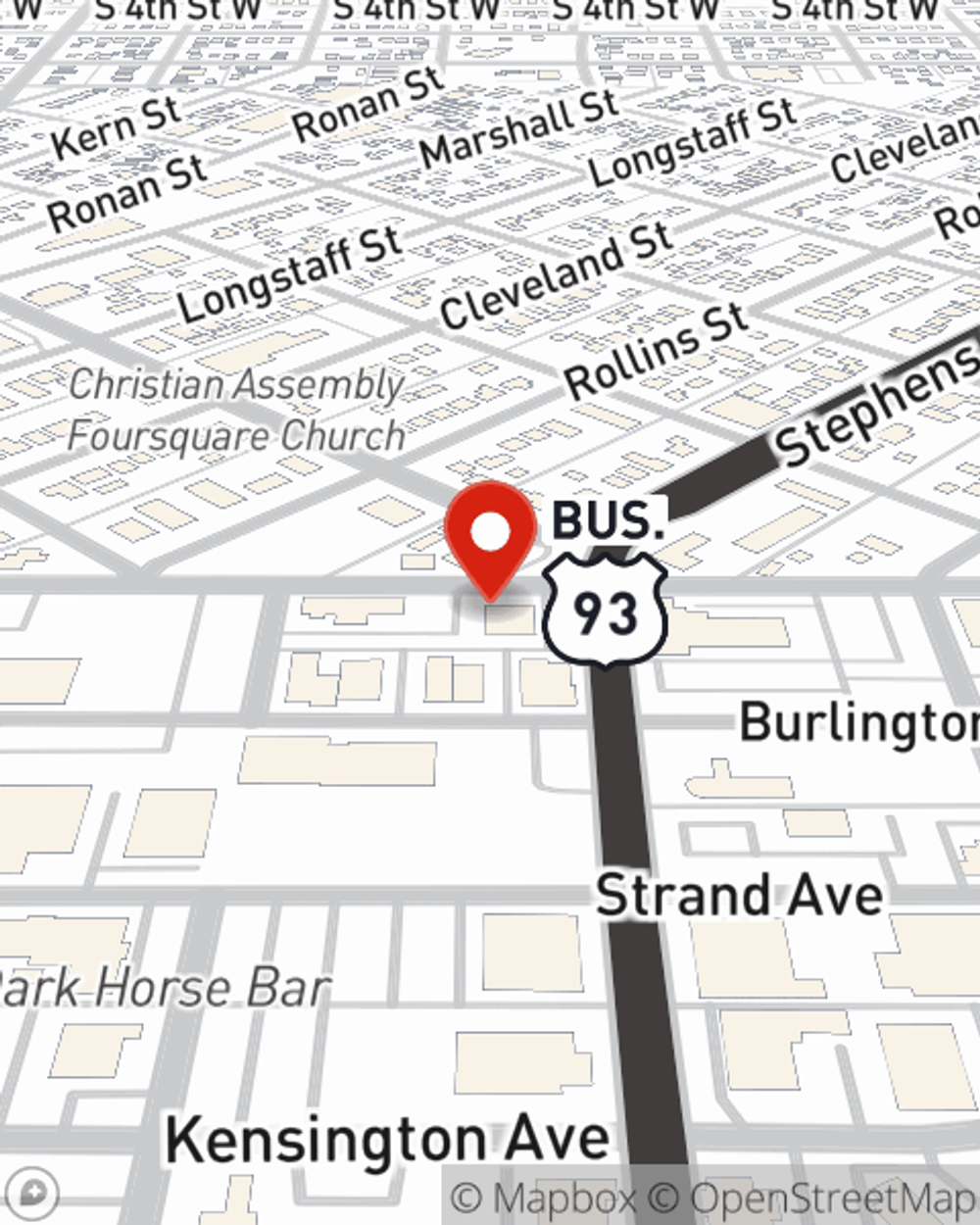

Get in touch with State Farm agent Darby South today to find out how the trusted name for small business insurance can safeguard your future here in Missoula, MT.

Simple Insights®

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Ways to help set financial goals

Ways to help set financial goals

As a business owner, your financial goals should be split into two worlds: one set for your business and another for your personal life.

Darby South

State Farm® Insurance AgentSimple Insights®

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Ways to help set financial goals

Ways to help set financial goals

As a business owner, your financial goals should be split into two worlds: one set for your business and another for your personal life.